For anyone building or converting a new home, it’s recommended for the builder to purchase a structural warranty before construction even begins. This insurance policy will legally protect the homeowner if structural defects are discovered during the first several years after completion.

Even the best of builders can’t always guarantee there won’t be any issues with materials or the quality of their work down the line. A Building Control Completion Certificate can confirm that it meets health and safety regulations, but it won’t protect you financially if something goes wrong.

The National House Building Council (NHBC) and Local Authority Building Control (LABC) are two of the most recognized warranty providers in the UK, along with Premier Guarantee. Just as you need reassurance that you’re protected against future damage and structural failures, so will any financial lenders before they help you purchase the property. Let’s look further into the reasons why a 10-year structural warranty should be a priority.

Introduction to Mortgage Approval

Mortgage approval is a crucial step in the home-buying process, involving several key factors such as the property’s value, the buyer’s creditworthiness, and the presence of a valid building warranty. A building warranty, also known as a structural warranty, offers assurance to mortgage lenders that the property is structurally sound and meets specific building standards. In the UK, mortgage lenders typically require a building warranty for new build properties to mitigate risks associated with structural defects.

The National House Building Council (NHBC) and Local Authority Building Control (LABC) are two of the most recognized warranty providers in the UK. These organizations offer warranty schemes that align with the stringent requirements of mortgage lenders, ensuring that the property adheres to high building standards. Understanding the role of building warranties in the mortgage approval process is essential for anyone looking to secure a mortgage for a new build property.

Key Takeaways

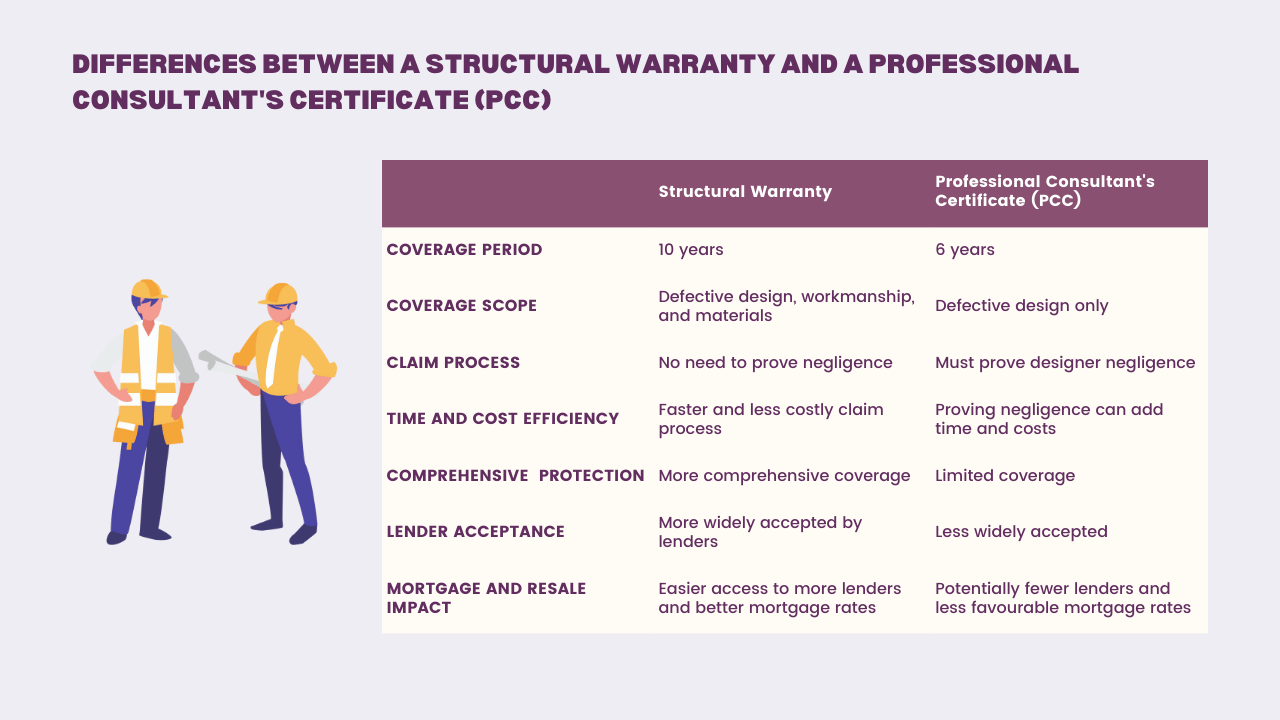

- A structural warranty provides extensive coverage, including defects in design, workmanship, and materials, for 10 years.

- The claim process under a structural warranty is simpler and faster since proving negligence is not required.

- Professional Consultant’s Certificates (PCCs) cover only design defects for 6 years and require proof of negligence for claims.

- Mortgage lenders often prefer properties with a structural warranty, making it easier to secure a mortgage and better rates.

- Structural warranties are transferable to new owners, increasing the property’s resale value and marketability.

- Mortgage lenders have specific lending criteria that often require a structural warranty for mortgage approval.

Why do I need a 10-year structural warranty?

Fixing structural issues after work is completed can be very expensive for homeowners. However, insurance against defective design, materials, or workmanship can cover the costs of rebuilding or fixing those problems. This makes it essential to find trusted financial institutions offering Over 55 Equity Release if you’re buying a home.

A structural warranty is necessary for all types of properties, whether new builds or conversions, from single houses to apartment buildings. It protects the owner or buyer if the building company goes bankrupt during the process. A build zone structural warranty is another option that provides comprehensive coverage for new home constructions.

Structural warranties typically cover a period of 10 years from the completion of construction. Hence the name “10-Year Structural Warranties.” But do you know exactly what they cover and what they don’t?

What does a 10-year structural warranty cover?

A good structural warranty should protect you from the beginning. This means that if the builder becomes insolvent before finishing construction, you won’t lose your deposit. Once the property is complete, the 10-period will start.

Chartered surveyors play a crucial role in evaluating warranty schemes and ensuring compliance with building regulations.

The first 2 years cover defect insurance, meaning the builder is legally obliged to fix any issues that occur due to defective construction during this time. Such issues include faulty pipes or window sealing – at no extra cost to you.

From the third year onward, the remainder of the 10-year policy covers structural insurance. During this period, the builder will only be responsible for major structural problems. Roofs, ceilings, foundations, or load-bearing parts of floors are some common examples.

Smaller issues, such as fixtures and fittings, are now the homeowner’s responsibility to deal with. The structural warranty won’t cover natural wear and tear, lack of maintenance, or weather damage. It’s usually just a precaution, but a worthwhile one. You don’t want to be shelling out for structural repairs several years after buying your new home.

Can’t I get a CML Professional Consultant’s Certificate instead?

You might have heard that an architect’s certificate from the Council of Mortgage Lenders (CML) is cheaper than a structural warranty and wondered why it’s not the first choice. Unlike a structural warranty, a CML certificate, or Professional Consultant’s Certificate (PCC), isn’t an insurance policy.

The certificate only confirms that your building meets legal standards and holds the builder liable for six years under their indemnity insurance. If a structural issue arises, the owner must take the builder to court during this time.

A CRL warranty is another type of structural defects insurance policy that is often considered by lenders.

Proving professional negligence falls on the buyer or homeowner, which can be lengthy and costly. If you lose the case or the company goes out of business, you bear the costs.

A PCC or CML certificate might work for self-builders with a limited budget, especially for conversions rather than new builds. Some lenders accept an architect’s certificate, but many don’t. For full protection and better mortgage options, investing in a structural warranty is advisable.

Self-Builders and Warranties

Self-builders, or individuals who build their own homes, often face unique challenges when it comes to obtaining a building warranty. Unlike developers, self-builders may not have access to the same warranty providers and may need to seek out specialist warranty providers that cater to self-build projects. The Self-Build Zone and Build Zone are two examples of warranty providers that offer building warranties specifically for self-builders.

Self-builders must ensure that they meet the requirements of their lender and obtain a building warranty that covers structural defects for a minimum of 10 years. The build warranty, building warranties, and warranty schemes are all essential considerations for self-builders. It is also crucial to consider the total cost, including reasonable costs, and the potential risks associated with self-build projects. By securing a comprehensive building warranty, self-builders can protect their investment and meet lender requirements.

Specialist Brokers and Mortgage Approval

Specialist brokers play a crucial role in the mortgage approval process, particularly for buyers who require a building warranty. These brokers have expertise in navigating the complex world of building warranties and can help buyers find the right warranty provider to meet their needs. Specialist brokers can also assist buyers in understanding the requirements of their lender and ensuring that they meet those requirements.

By working with a specialist broker, buyers can increase their chances of obtaining mortgage approval and securing a building warranty that meets their needs. The mortgage application, lender requirements, and warranty period are all critical factors that specialist brokers consider when advising clients. Additionally, brokers must stay up-to-date with the latest developments in the industry, including changes to warranty schemes, building standards, and lender requirements. This expertise can be invaluable in helping buyers navigate the mortgage approval process successfully.

Do I still need home insurance if I have a structural warranty?

A new home warranty is not the same thing as a home insurance policy, so yes – you do need to have both. Mortgage lenders expect applicants to have both of these policies in place, because they want to protect their investment in the building just as much as you do until you’ve paid it off.

Properties built using modern methods of construction may have specific considerations during the lending and warranty processes.

As we’ve discussed, the structural warranty doesn’t cover accidents, ageing, or weather damage, which is where building insurance comes in. This element of home insurance covers the integrity of the structure itself, but doesn’t cover things like poor construction or contaminated land.

It’s also advisable for any homeowner to get contents insurance, which covers your possessions in case of theft, fire, flooding, or accidental damage. However, this type of home insurance isn’t a requirement for financial lenders, as they only cover the costs of the structure and not its contents.

Can I legally get a mortgage without a structural warranty?

Structural warranties aren’t technically a legal requirement, so it’s not compulsory to get one. That said, you’re likely to find it incredibly difficult to secure a mortgage loan without one. Even on the rare occasion that a lender doesn’t require this, they’re likely to lend you less than they would if you did have a structural warranty, as not having one makes you more of a financial risk for them.

Structural defects insurance is crucial for protecting both the homeowner and the lender against potential issues.

Most mortgage providers require a structural warranty to be in place before the start of any building work. They may still accept your initial application if you don’t have one, but only if you agree to complete the commitment before the project is finished. The property inspections that occur as part of the policy can be used as proof of the project’s current stages for the release of funds.

Another benefit is that selling your property will be much easier, if you intend to do this within the next 10 years after purchase. It will be a much more attractive prospect to new buyers if they know that this insurance policy is in place – the warranty stays with the property, so it should transfer to the new homeowners for the remainder of the term if they complete the sale.

You should bear in mind that any further construction work that takes place during those 10 years may invalid the first warranty, so you’re likely to need to update or replace the contract. Always check the small print to confirm that your warranty covers everything you need it to, and go with a CML-approved structural warranty provider, as banks are more likely to accept their certificates.

Conclusion

In conclusion, a structural warranty is an important investment for anyone building or converting a new home. It provides complete protection against defects in design, workmanship, and materials for 10 years, ensuring financial security and peace of mind. Unlike a Professional Consultant’s Certificate (PCC), a structural warranty does not require proving negligence to make a claim, making the process faster and more efficient. Mortgage lenders often prefer properties with a structural warranty, which can result in better loan terms and rates. Additionally, the warranty’s transferability adds value to the property, enhancing its resale potential. Understanding the coverage of your warranty can prevent unexpected issues arising in the future. Overall, securing a structural warranty is a prudent step for both new homeowners and those looking to secure promising mortgage options.

Frequently Asked Questions

Can I get a mortgage without a structural warranty?

While not legally required, securing a mortgage without a structural warranty is extremely difficult. Lenders may offer less favourable terms or reduced loan amounts without it. Zurich Municipal is one of the reputable warranty providers that lenders often recognize.

What does a 10-year structural warranty cover?

It covers defects in design, materials, and workmanship. The first 2 years cover defect insurance, and the remaining 8 years cover major structural issues. The warranty also ensures that any defects in completed housing are covered, providing peace of mind for homeowners.

Lender Requirements

Mortgage lenders have specific requirements when it comes to building warranties, and these can vary from one lender to another. Generally, lenders require a building warranty that covers structural defects for a minimum of 10 years. This warranty must be provided by a recognized warranty provider, such as the NHBC or LABC, and must meet the standards set by the UK Finance Mortgage Lenders’ Handbook.

In addition to the building warranty, lenders may also require additional documentation, such as a Professional Consultant’s Certificate (PCC), to confirm that the property has been built to certain standards. The warranty period, defects insurance, and structural integrity are all critical factors that lenders consider when evaluating a mortgage application. It is essential to check with your lender to determine their specific requirements for building warranties to ensure a smooth mortgage approval process.

How does a PCC differ from a structural warranty?

A PCC covers only design defects for 6 years and requires proof of negligence for claims. A structural warranty covers a wider range of issues for 10 years without needing to prove negligence. Having a structural warranty can facilitate the approval of mortgages, making it easier for buyers to secure financing.

Do I need both home insurance and a structural warranty?

Yes. A structural warranty covers construction defects, while home insurance covers damage from accidents, weather, and other external factors.

Build warranties are essential for protecting against construction defects and ensuring compliance with lender requirements.

Is a structural warranty transferable?

Yes, a structural warranty is transferable to new owners, making the property more attractive to potential buyers. Build Assure is one of the warranty providers that offer transferable warranties, enhancing the property’s resale value.